Why you need to implement a Mobile Wallet (and how to do it)

Mobile wallets are revolutionizing the way we handle money, transforming our smartphones into powerful financial tools. Mobile wallets have quickly become a game-changing innovation in the financial industry, offering numerous benefits to banks and fintech companies that choose to adopt this technology.

Some numbers that help understand Mobile Wallet potential:

The adoption rate of mobile wallets is highest among millennials, with 67% using them regularly.

Mobile wallets are expected to account for 80% of all digital payments by 2023.

Mobile wallet usage is expected to reach 56% of the US population by 2025.

The global mobile wallet market is projected to reach $7.6 trillion by 2027.

In this article, we will explore the numerous benefits of implementing a mobile wallet for banks and fintech companies and share insights, ideas, and tips on how to make it happen. Let’s explore some of the key advantages that make mobile wallets an attractive proposition for financial institutions:

- Why mobile wallets are essential

- How mobile wallets can boost your business

- The process of implementating a Mobile Wallet

The Rise of Mobile Wallets and Why Your Business Should Implement One

In recent years, the mobile wallet landscape has experienced immense growth, transforming how consumers make payments and manage their finances. Businesses, especially banks and fintech companies, need to stay ahead of the curve and embrace this innovation. In this section, we’ll explore why your business should implement a mobile wallet and the benefits it brings.

Mobile wallets have the potential to revolutionize the way we pay for goods and services.

– Jack Dorsey

Mobile Wallets: Convenience and Speed

Mobile wallets offer unmatched convenience and speed for customers, enabling them to make payments with just a few taps on their smartphones. This significantly reduces the time spent in queues and eliminates the need for carrying cash or physical cards. By implementing a mobile wallet, your business can provide a seamless and efficient payment experience for your customers.

Increased Security and Fraud Prevention for Mobile Wallets

Security is a top concern for customers when it comes to financial transactions. Mobile wallets use biometric authentication, advanced encryption and tokenization technologies to protect sensitive data, making them more secure than traditional payment methods. By adopting a mobile wallet, your business can reassure customers that their financial information is safe and well-guarded.

Use your Mobile Wallet for Customer Loyalty and Engagement

Mobile wallets provide a platform for businesses to engage with customers through personalized offers, loyalty programs, and targeted promotions. This helps in fostering customer loyalty and increasing repeat business. By implementing a mobile wallet, your business can leverage these features to strengthen customer relationships and boost revenue, and ultimately retain and attract more clients.

Get Data-driven Insights and Analytics of your Mobile Wallet

Mobile wallets capture valuable data on customer spending habits and preferences, allowing your business to gain insights into their behavior. This data can be utilized to optimize marketing strategies and develop targeted marketing campaigns, tailor product offerings, and improve overall customer satisfaction. Implementing a mobile wallet can help your business make data-driven decisions and stay competitive in the market.

Innovation and Competitive Advantage

By embracing mobile wallet technology, banks and fintech companies can stay ahead of the curve and set themselves apart from competitors. Offering a mobile wallet solution demonstrates a commitment to innovation and customer-centricity, which can help attract tech-savvy consumers and ensure long-term success in the ever-evolving financial landscape.

How Mobile Wallets can help Lower Costs and Improve Efficiency?

Mobile wallets can reduce the costs associated with handling cash and processing card payments, such as transaction fees and chargebacks. Additionally, they streamline the payment process, resulting in improved operational efficiency. By adopting a mobile wallet, your business can benefit from cost savings and enhanced payment processing capabilities.

Implementing mobile wallet solutions can lead to significant cost savings for financial institutions. By reducing the need for physical branches, printed materials, and manual transactions, mobile wallets can help banks and fintech companies streamline their operations, improve efficiency, and lower overhead costs.

The Benefits of Mobile Wallets for Banks and Fintech Companies

| Feature | Traditional Banking | Mobile Wallet |

|---|---|---|

| Accessibility | Limited by branch locations and hours | 24/7 access from anywhere with an internet connection |

| Transaction Speed | Slower due to manual processes and paperwork | Instant transactions and real-time updates |

| Security | Dependent on physical cards and PINs | Biometric authentication and encrypted data |

| Convenience | Multiple cards and cash to carry | All payment methods in one digital platform |

| Customer Experience | Less personalized and limited to in-person interactions | Personalized offers, rewards, and seamless integration with other services |

Now that we’ve established the advantages of implementing a mobile wallet for your business, it’s time to explore how to actually make it happen. In the next section, we’ll dive into the essential steps and considerations for a successful mobile wallet implementation.

How to implement a mobile wallet for your business

- Choose the right mobile wallet development strategy: Evaluate if you have a Mobile App Development team that is ready and has the experience to develop the mobile apps, or you need to look for a trusted partner that is experienced developing mobile wallets and mobile apps. Also you can evaluate different existing mobile wallet solutions, considering factors such as security, user experience, and integration capabilities with your existing systems.

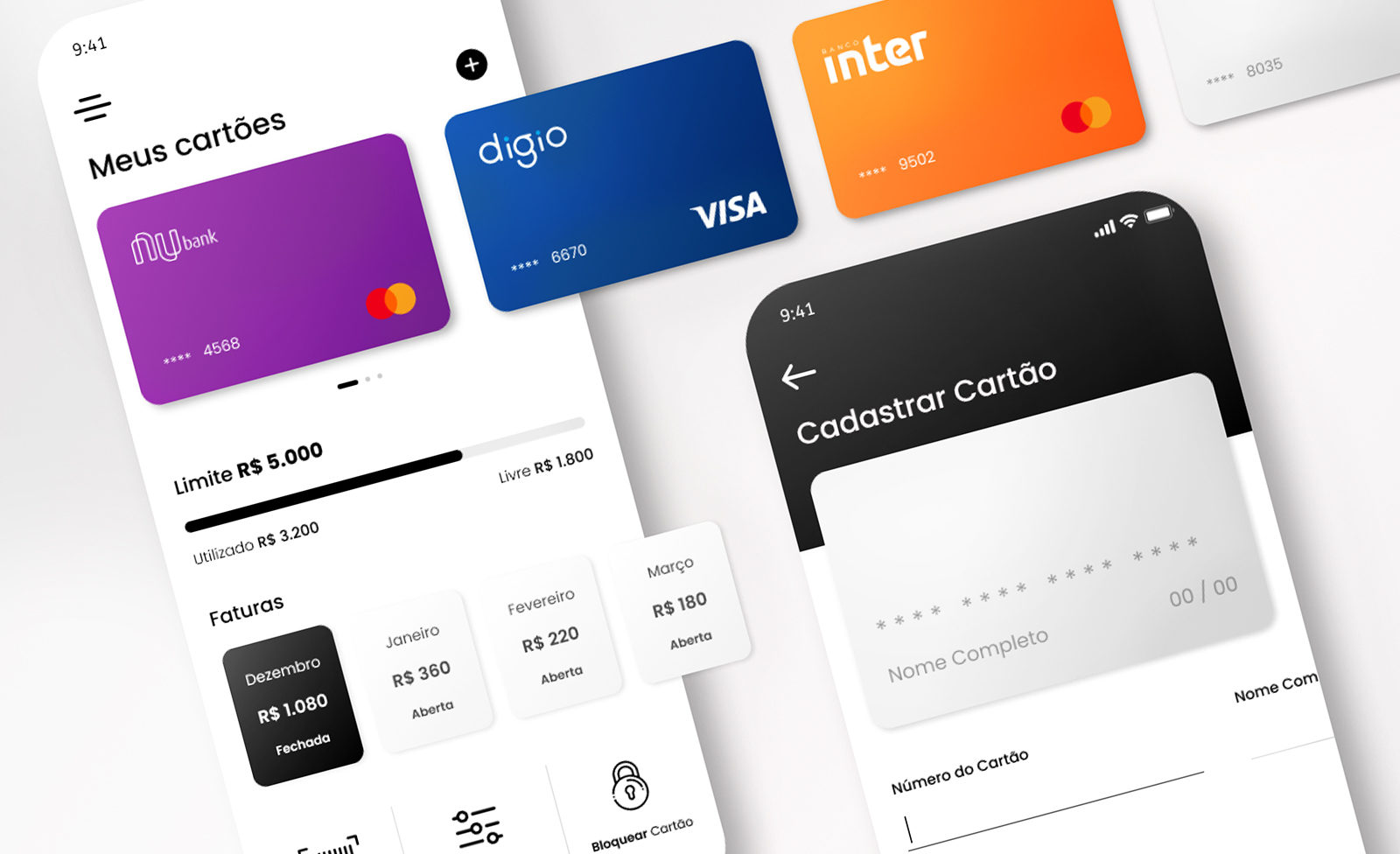

- Design a seamless user experience: Work with your product, development and design team to create a user-friendly interface that makes it easy for customers to navigate, add funds, and make payments.

- Ensure security and compliance: Implement robust security protocols, such as encryption and tokenization, and stay compliant with relevant regulations to protect customer data and ensure a secure transaction environment.

- Promote your mobile wallet: Launch targeted marketing campaigns to educate customers about the benefits of your mobile wallet and encourage adoption.

- Analyze and optimize: Continuously monitor your mobile wallet’s performance, gather feedback from customers, and make improvements to enhance user experience and drive growth.

By understanding the benefits of mobile wallets and implementing them effectively, your business can experience significant growth, customer satisfaction, and increased revenue. Don’t miss out on this opportunity to stay ahead in the competitive financial landscape.

Conclusion

In conclusion, implementing a mobile wallet is no longer a luxury but a necessity for banks and fintech companies. It not only enhances the customer experience but also provides a competitive edge in a rapidly evolving market. Embrace the future of banking and financial services by investing in a robust mobile wallet solution today.

Ready to take the leap? Consider partnering with ThinkUp, an experienced fintech app development company that understands the intricacies of mobile wallet implementation. Let us help you transform your business and stay competitive in today’s fast-paced world.

Contact ThinkUp now to discuss your mobile wallet implementation needs and start your journey towards a more efficient, customer-centric future.